“Without this loan, we couldn’t have extended our church”

“When a property is owned by a charity, loan providers aren’t interested.” Custodial trustee Milton Rodosthenous explains why a Charity Bank loan was so important to The Twelve Apostles church.

Why does the church need an extension?

We need more space! The Twelve Apostles is a Greek Orthodox church. The Orthodox community has grown considerably over recent years, and it’s not just the Greek community who come to our church; we also have a number of people from Eastern European Orthodox communities.

We have an amazing committee, who’ve really opened the church up to the wider community. The church now has a thriving food bank. With the cost-of-living crisis, demand for the food bank has really increased. So, we need more storage space as well as more space for our growing congregation.

On top of that, we’re creating an adult baptism pit and a private meeting space for our priest. Father Joseph is a real inspiration to the whole community, so people want to speak to him, but at the moment, they can’t have a private conversation because there’s nowhere to go.

Why did you choose Charity Bank for your church’s loan?

I used to be a banker, many years ago, so I soon realised it wasn’t going to be easy to get a loan. The church owned an unencumbered property around the corner, so you’d think we could have got a normal buy-to-let mortgage, but it’s not that easy. When a property is owned by a charity, loan providers just aren’t interested.

So, we needed a specialist provider. Our broker put us in contact with two or three different organisations. When we saw what Charity Bank does in the community and what it stands for, we knew it was the one to go for. We had a long chat with Charity Bank and realised, “These people can help us, not just to get a loan, but also to really make that loan work for us.” Our aspiration is to get this debt paid off as soon as possible, so we needed the flexibility to do that.

How did you find the loan process?

The process was what I expected. Charity Bank are a delight to deal with. Most banks don’t understand charities or know what to do about trustees, whereas Charity Bank knows what it’s doing. That makes life so much easier.

Our first point of contact at Charity Bank was Carolyn Sims. She then appointed John Murray to deal with our application, and he came down to meet with us. He’s a great guy, really helpful.

There are lots of hoops to jump through when you’re a charity, but we jumped through them all and got there in the end.

Could you have built the extension without a loan?

No. Some members of the community have donated money towards it, but without the loan, we couldn’t have built the extension, so I’m really glad we found Charity Bank!

You must be excited about what’s ahead?

Yes. The extension is going to make a significant difference. For a start, we’ll be able to hold our own large functions to celebrate saints’ days and other events, rather than having to rent space for them. We should be able to double our food bank distribution, and expand our other community services, such as teaching computer skills to the elderly.

At the beginning of the year, the Patriarch visited us and blessed the extension. He’s the spiritual leader of the whole Orthodox community – our version of the Pope. He only visited two or three UK Orthodox churches during his stay, and he also visited King Charles, so having him choose our church was a pretty big deal!

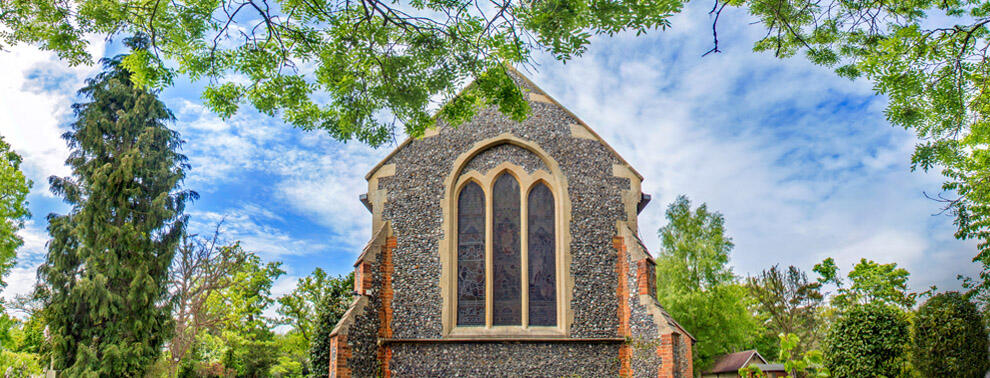

The committee built this church from nothing; it was an old rundown Church of England building that was heading to ruin. The committee bought it, refurbished it, extended it and have created a place where hundreds of people come every week.

If you need a loan for your church, please call Charity Bank on 01732 441919.

About Charity Bank

Charity Bank is the loans and savings bank owned by and committed to supporting the social sector. Since 2002, we have used our savers’ money to make more than 1400 loans totalling over £605m to housing, education, social care, community and other social purpose organisations.

Nothing in this article constitutes an invitation to engage in investment activity nor is it advice or a recommendation and professional advice should be taken before any course of action is pursued.