Social Impact Report

Welcome to our Impact Report for lending activity in 2023 and 2024

Introduction from our CEO

Dear reader,

At Charity Bank, we believe finance should be a force for good. In a year marked by economic uncertainty and rising social need, we remained steadfast in our mission: to support the organisations that are changing lives, strengthening communities, and protecting our planet.

In 2024, we reached a new record – disbursing a record £70.0 million in new loans to UK charities and social enterprises, building on the strong £53.5 million distributed in 2023.

These funds helped to build affordable homes, expand vital services, and empower organisations working at the heart of their communities. Our borrowers told us that 93% chose Charity Bank because we understand their unique challenges, and 82% because our values align with theirs.

During 2023-24 we expanded our activity in the green lending space with blended finance products to support energy efficiency investments by social sector organisations. These efforts are part of our broader strategy to help our borrowers transition to a low-carbon future while reducing their operating costs.

Our LEAP (Lending Equal Access Programme) and cost-of-living finance programme provided critical support to smaller, often diverse-led organisations that have historically struggled to access funding. These initiatives are helping to close the finance gap and ensure that social investment reaches those who need it most.

2024 also marked the launch of our Brighter Futures Fund, a new initiative using a portion of our surplus funds to support impactful organisations that fall outside the scope of traditional lending. This fund reflects our deepening commitment to inclusive finance and our belief that no organisation doing good work should be left behind.

As always, our work is made possible by our savers, individuals and institutions who choose to align their money with their values. By saving with us, they are helping to build a more just, inclusive, and sustainable society.

As you read this report, I hope you’ll take away more than just the numbers. I hope you’ll pause with each story and see the people behind the data, the lives changed, the futures made brighter, the communities strengthened. These stories speak louder than any statistics. They are the reason we do what we do.

Thank you for being part of our journey.

Ed Siegel

Chief Executive

Impact Highlights for 2023 and 2024

£120m

lent to charities & social enterprises

167

charities & social impact-led enterprises supported

5561

savers supporting good causes

How we make an impact

Our Strategy for Impact 2023–2027

Strengthening Organisations

We help charities and social enterprises grow stronger and more impactful by offering tailored funding that meets their needs. By addressing gaps in finance and enhancing our service, we support organisations in building resilience and deepening their impact.

People, Communities and Planet

We prioritise lending to organisations supporting vulnerable and underserved groups. We also back green initiatives that cut emissions and promote sustainability, aligning our finance with both social and environmental goals for a fairer, more inclusive future.

Leading by Example

We embed our values internally by fostering an inclusive, respectful culture. Through equitable policies, flexible working, and talent development, we aim to lead by example, showing that a values-driven approach strengthens both culture and success.

How we make an impact

Challenge

Impact-driven organisations, particularly in disadvantaged communities, often struggle to access necessary finance. Addressing the UK's pressing social and environmental issues requires unlocking substantial capital beyond grants alone.

Vision

A society that fosters vibrant communities and a healthy planet, giving every individual the opportunity to thrive.

Mission

To support and strengthen impact-driven organisations that improve people’s lives, while empowering savers and investors to put their money to work for positive social change.

How our savers and shareholders help us create social impact

Our savers

When individuals or organisations deposit their funds with Charity Bank, they can be confident that their money is being used to support impactful organisations working towards social change.

Their savings directly contribute to addressing societal challenges and creating positive outcomes in communities. It’s not just an abstract notion of being ethical; it’s a concrete action that leads to tangible social impact.

Find Out MoreOur shareholders

Charity Bank’s ability to meet the ongoing needs of the social sector and support a wider range of social sector organisations relies on the capital investment from our shareholders and subordinated debt investors. They play a crucial role in our ongoing success and impact.

Social impact multiplied

For every £1m of investment capital (equity and subordinated debt), Charity Bank can make around £7m of social loans.

When the loans are repaid, these funds can be recycled again and again, generating even greater multiples of social impact. In addition, over half of our borrowers were, because of our loan, able to unlock additional funding such as grants or contracts.

“Investment is an important tool which can work alongside grant funding to help organisations thrive and create impact. We hope to demonstrate with our portfolio that trusts and foundations’ assets can be invested to help deliver their charitable aims.”

Caroline Mason CBE, CEO, Esmee Fairbairn

"Charities, social enterprises and faith-based organisations provide key services to local communities in areas such as housing, social care, food banks, skills development and tackling loneliness. Charity Bank loans are a vital part of the funding landscape for these organisations, enabling them to sustain, improve and grow their services.”

Vanessa Morphet, Head of Social Impact Investment at the Church of England

Impact in numbers

Key results from all drawn loans between 2023-2024

Where our loans went

Our regional managers support organisations across England, Scotland, Wales, and Northern Ireland. Click the map to explore how much we lent to charities and social enterprises in your region during 2023 and 2024.

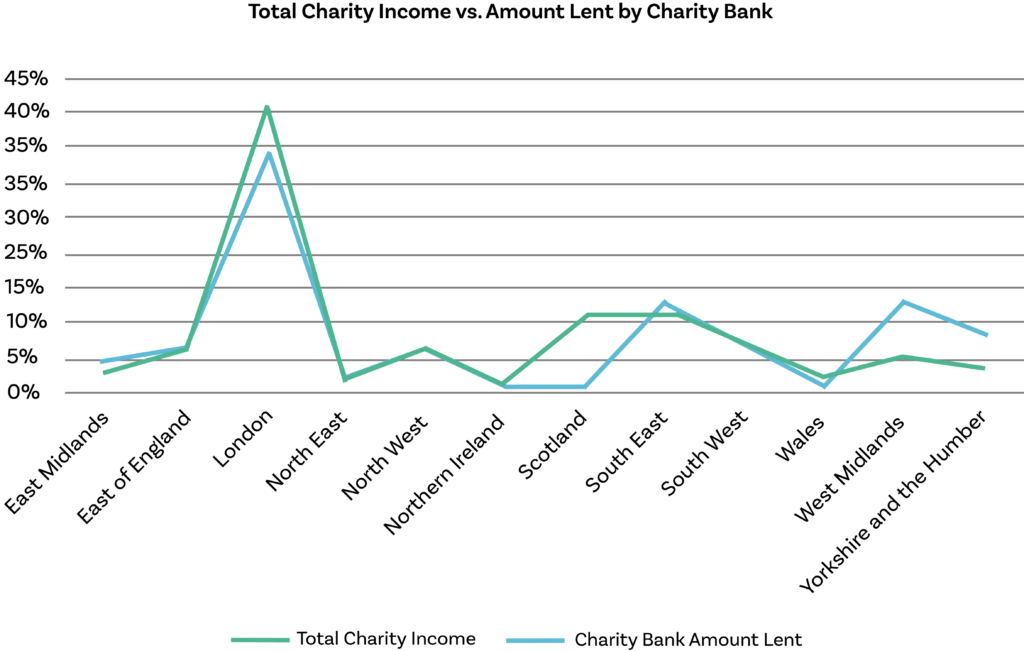

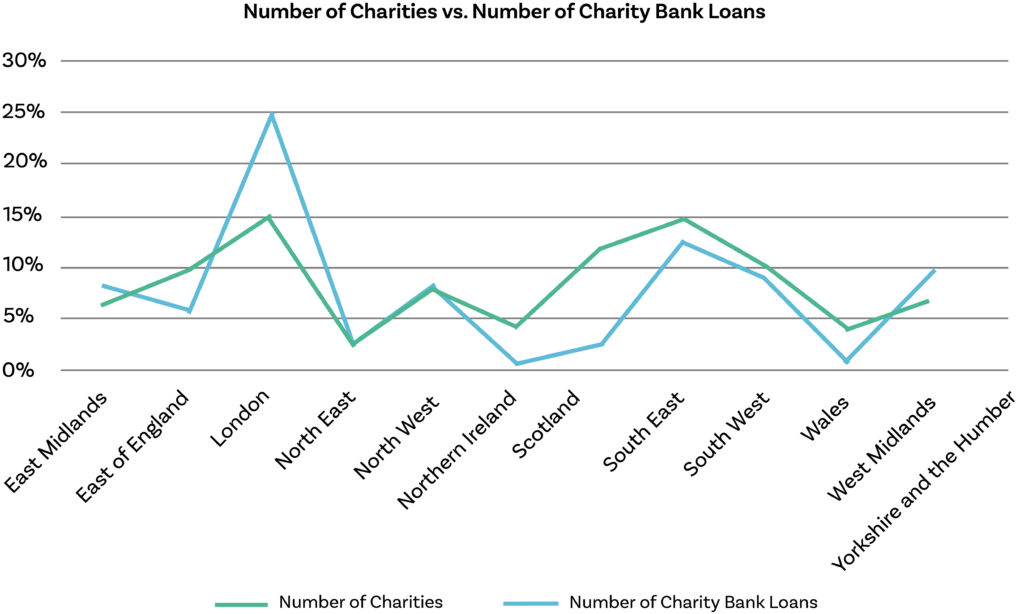

Our goal is to reach every part of the UK in proportion to the need. As the charts below show, our lending closely reflects the distribution of UK charities and their total income by region. One exception is Scotland, where our activity has been lower than we’d like. Closing this gap is a key focus in our current planning.

The types of organisations we have supported

What our loans were used for

Impact in action

How our loans benefit people, communities and the planet

Impact in action

Strength and Learning Through Horses

“All of the young people we support are struggling with their mental health. Many have experienced trauma or neglect.”

Find out how Strength & Learning Through Horses is helping.

Find Out MoreHow our loans benefit people, communities and the planet

From urban sports centres to affordable housing and environmental innovation, Charity Bank’s support is helping organisations create lasting impact across society and the environment.

Community

Adrenaline Alley: a world-class urban sports centre

“Without the Charity Bank loan, we would not have been able to grow and develop in the same way. We’ve also been able to make some significant improvements, such as building a two-storey café, diversifying our revenue income and ensuring sustainability.”

Mandy Young MBE DL, CEO/founder Adrenaline Alley

People

Homes for Good

“Charity Bank was the most enthusiastic and really believed in what we wanted to do. Charity Bank has been a 100% supportive partner from the start and I know I can just pick up the phone if I want any advice.”

Susan Aktemel, Founder Homes for Good

Planet

Eden Project

“Charity Bank was recommended to us by one of the major foundations that we work with. When we got talking to them [Charity Bank] we realised very quickly that we were very much aligned with the values that we had as organisations and we were very excited to work with them.”

Dawn Wilding, Eden Project, Chief Financial Officer

Strategy in focus

How we’re performing against our impact strategy

Our Strategic Priorities

Our 2023–2027 Strategy for Impact sets out a clear and targeted vision for how we aim to use our savers’ and investors’ money to create meaningful change. It defines the outcomes we seek and the principles that guide our lending decisions. In this section, we review our progress against each of our strategic priorities.

- Customer

Continually improve service to become the lender of choice for UK impact-driven organisations. - Additionality

Fill gaps in finance provision with tailored funding for the social sector. - Strengthen

Build borrower resilience and capacity to help them deliver their mission. (Covered in the section above.) - Diversity

Extend outreach to groups that have been systematically underfunded. - Depth of Need

Prioritise organisations serving the most vulnerable and marginalised. - Locality

Increase lending in underserved regions and communities. - Environment

Grow our green lending to help customers cut costs and carbon emissions.

Impact in line with our strategic plan

- Locality: £59.3m to low income communities

- Additionality: £29.8m to those unable to access finance elsewhere

- Diversity: £37.7m to diverse-led organisations

- Strengthen: 189 organisations addressing social need supported

- Environment: 18 organisations supported to improve their energy efficiency

Supporting the most deprived communities

Deprived communities are those in the lowest 30% of indices of multiple deprivation in the UK.

46%

Most Deprived

Of Charity Bank's loan approvals in 2023-2024, 46% went to the 30% most deprived communities in the UK.

40%

Average

Of Charity Bank's loan approvals in 2023-2024, 40% went to the middle 40% of indices of deprivation in the UK.

14%

Least Deprived

Of Charity Bank's loan approvals in 2023-2024, 14% went to the 30% least deprived communities in the UK.

Access to finance

In 2023 and 2024, Charity Bank approved loans to a wide range of organisations – many of whom may have otherwise struggled to access the funding they needed.

Lending to Diverse-Led Organisations

Informed by the recommendations of the Adebowale Commission on Social Investment, we have made a deliberate commitment to support diverse-led organisations, groups that have historically faced systemic barriers to funding.

Between 2023 and 2024, we approved a total of £37,719,652 in loans to 55 diverse-led organisations.

47% of these diverse-led organisations reported being unable to access finance from mainstream sources, significantly higher than the 30% average across all our borrowers.

Our programmes

We support our strategic impact goals through key programmes. The snapshot below highlights results from LEAP and Green (2023–24), and from Cost of Living and BFF launched in 2024.

Cost of Living

Our Cost of Living programme supports organisations implementing initiatives to help communities impacted by the cost-of-living crisis. Charity Bank funded £1,328,400 Cost of Living grants and £1,090,001 Cost of Living loans. Grants and loans went to 27 organisations, 8 of which were diverse-led and 24 support the most deprived communities.

Green Programme

In 2023–2024, Charity Bank supported 18 organisations through its Green Programme, which includes green loans, grants, and funded energy assessments. A total of £674,198 was disbursed. Of the recipients, 9 serve the most deprived communities. The programme supports efforts to reduce carbon emissions and reliance on fossil fuels.

Lending Equal Access Programme (LEAP)

LEAP funds historically under-funded organisations. Charity Bank funded £225,515 LEAP grants and £3,319,500 LEAP loans. Grants and loans went to 25 organisations, 11 of which were diverse-led and 17 support the most deprived communities.

Brighter Futures Fund (BFF)

The BFF provides grants to diverse-led organisations and those operating in the UK’s most deprived areas to help increase accessibility and reach. £224,000 of grants went to 6 organisations.

Bank of Choice

Charity Bank is committed to being the lender of choice for the UK’s impact-driven organisations, supporting their vital work with efficient, values-led service. Our Net Promoter Score (NPS) for new loans made in 2023 and 2024 ranks us in the top 5% of financial institutions, based on benchmark data from CustomerGauge.

Explore what our borrowers have shared about why they chose Charity Bank and how we’re doing.

Our accreditations

As a bank on a social mission to do good, Charity Bank has sought out independent certification of our values and ethics. These help us in our aims to gain the trust of a growing community of savers and borrowers. Charity Bank currently has accreditation or affiliation with all of the following bodies:

Saving with Charity Bank

With us your savings become a powerful force for good. In a Charity Bank savings account you can earn interest and make a positive difference to UK communities.

More Charity Bank Reports

Read our other reports to learn more about us and our work.

Your bank for good.

Join an ethical bank that uses its savers’ money to lend to charities and social enterprises. We bring together passionate savers, who want their savings to make a difference, with organisations seeking loans to create real change in the lives of people, communities, and the planet – both now and for the long term.